For investors who have wisely diversified into physical precious metals, choosing segregated gold storage or other storage arrangements is a crucial decision. Beyond protecting your investment from theft, the right precious metals depository partner can ensure the identity, security and accessibility of your holdings for generations.

Whether your investment includes gold, silver, platinum or palladium coins, bars or rounds, the storage method you choose – be it segregated, allocated/non-segregated or pooled – can significantly influence your ability to make the most of your bullion over the long term.

This article will clarify the critical distinctions between the various storage approaches, revealing how segregated precious metal storage uniquely empowers investors.

Precious Metals Storage Options Defined

Before diving into their nuances, let’s define the three primary forms of storage for precious metals utilized by most modern depositories:

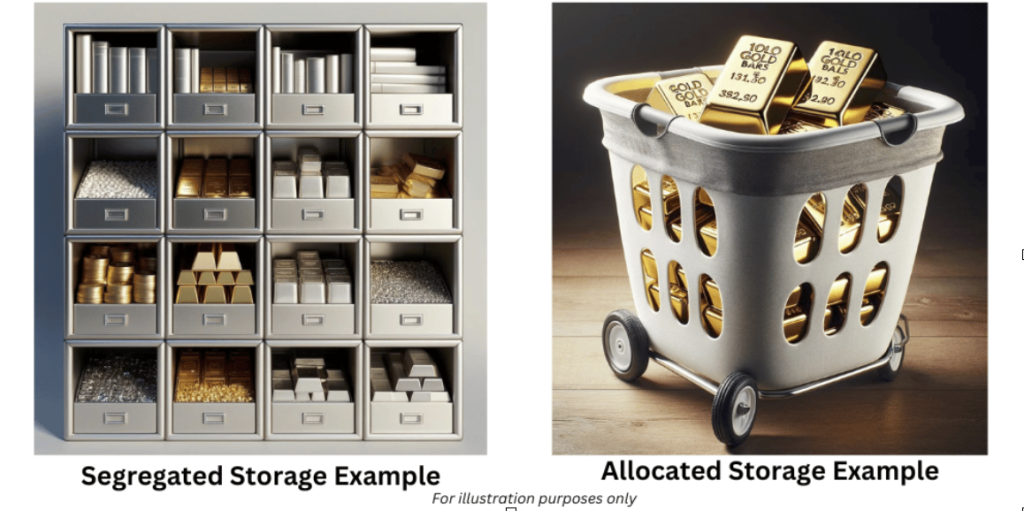

- Segregated Storage—Each client’s metals are stored completely separate from other investors’ holdings for unambiguous ownership verification and handling.

- Allocated Storage / Non-segregated—Investor’s metals are commingled with holdings of other investors and are identified only by product type, size/weight.

- Pooled Storage—No particular metals are pinpointed to any individual investor. Collective pool quantity claims are issued instead.

Real-Life Example of Segregated Gold Storage: John’s Gold Coin Investment

To envision how these modalities differ practically, consider a hypothetical precious metals investment:

Meet John Smith, a savvy investor who has purchased 50 American Eagle one ounce gold coins through a respected national dealer to diversify his portfolio.

After John purchased the American Eagle coins, his precious metals dealer sent them to be stored at a precious metals storage facility.

Now let’s examine how John’s 50 gold coins could be handled distinctly across the three primary storage options:

Segregated Gold Storage

- John’s specific 50 coins are logged under his account and placed into his unique storage box without commingling with other investor’s gold.

- When it is time to take delivery of his investment, he will receive the exact 50 coins originally deposited.

Allocated/Non-Segregated Storage

- John’s 50 coins are identified as belonging to him but comingled with common batches.

- Ownership is anonymized, with weight/purity recorded.

- When it is time to take delivery of his investment, he will not receive the same 50 coins originally deposited.

Pooled Storage

- No particular 50 coins are ever assigned to John individually.

- His account simply reflects ownership of “X fine ounces of gold” instead.

- When it is time to take delivery of his investment, he will not receive the same 50 coins originally deposited.

Intuitively, a segregated storage account offers John the strongest assurances, protections and control over his specific 50 American Eagle gold coins.

The Benefits of Segregated Gold Storage

- Ownership: Your gold is stored separately from other clients’ holdings, giving you direct ownership of specific bullion.

- Enhanced Security: With segregated storage, your precious metals are stored separately from other investors’ holdings, providing an extra layer of security.

- Transparency: Easier to verify and audit your exact holdings.

- Preserved Condition: Your metals remain in the exact condition as when they were delivered, ensuring you won’t receive any metals that have been handled or stored under different conditions.

- Peace of mind: Knowing your exact gold bars or coins are set aside for you.

International Depository Services Group (IDS) exclusively offers segregated storage options for private precious metals investors. This policy reflects our commitment to providing our clients with the highest level of security and transparency.

By only offering segregated storage, IDS ensures that each investor’s precious metals are individually accounted for and stored separately, eliminating any potential confusion or commingling of assets. This approach aligns with our focus on meeting the needs of discerning investors prioritizing direct ownership and verifiable holdings in their precious metals investments.

Addressing Common Segregated Gold Storage Concerns

While segregated gold storage offers numerous benefits, it’s natural for investors to have questions and concerns about this option. Let’s address some of the most common issues:

- Cost: While segregated gold storage may sometimes have slightly higher storage fees than allocated/non-segregated or pooled options, the added security, control and peace of mind it provides are well worth the investment. In some cases, the incremental fee is less than $50 per year. A small price to pay for added security.

- Logistics: Reputable depository partners like IDS Group handle all the logistics of segregated storage, making it easy and hassle-free for investors to store their gold and silver investments safely and securely.

By understanding and addressing these concerns, investors can make informed decisions about whether segregated gold storage aligns with their investment goals and risk tolerance.

Segregated Gold Storage: Segregate Your Precious Metals Investment with IDS Group for True Empowerment

Choosing segregated storage with IDS Group empowers investors with unparalleled control and security over their precious metals holdings.

By opting for this premium service, you’re not just storing your assets; you’re safeguarding your financial future with a level of transparency and ownership that other storage options simply can’t match.

IDS Group’s commitment to segregated storage ensures that your specific gold bars, silver coins, or other precious metals are set aside exclusively for you, allowing for easy verification and peace of mind. This approach aligns perfectly with the needs of discerning investors who demand the highest standards of security and accountability.

With IDS Group, you’re not just an account number in a pooled system – you’re a valued client with tangible, identifiable metals stored securely under your name.

Embrace the power of true ownership and take control of your precious metals investment with IDS Group’s segregated storage solutions.

Contact IDS Group today to learn more about our segregated storage solutions and how we can help you protect and grow your wealth for generations to come.

Visit www.internationaldepositoryservices.com or visit one of our state-of-the-art depositories directly:

IDS OF DELAWARE

New Castle, Delaware

Toll-free: 888-322-6150

Email: info@IDS-Delaware.com

IDS OF TEXAS

Dallas, Texas

Toll-free: 888-322-6150

Email: info@IDSofTexas.com

IDS OF CANADA

Mississauga, Ontario

Toll-free: 855-362-2431

Email: Contact@IDSofCanada.com